EURUSD

- The EUR/USD is in a consolidation phase near 1.0910, after attempting to recover from the previous day's dip to the monthly low. This cautious movement characterizes the Tuesday morning trading session in Europe.

- The Euro-US Dollar pair reflects traders' caution as they await the release of US Retail Sales data for July. This data is expected to influence the pair's immediate direction.

- The Euro's movement could be further constrained by the ongoing holidays within the Eurozone, potentially contributing to muted market activity and limited price fluctuations.

- On the daily chart, EUR/USD has closed below the 100-day Moving Average (MA). Although full confirmation is yet to be established, this development could contribute to a more bearish technical bias.

- The day's trading is also expected to be influenced by the release of ZEW Economic Sentiment numbers for both Germany and the Eurozone. These figures will likely provide clearer signals for the pair's direction.

Closing statement: EUR/USD is currently engaged in a consolidation phase near 1.0910, following a recent rebound from its monthly low. The pair's movement remains cautious as traders await the release of US Retail Sales data. The presence of holidays within the Eurozone adds to the market's subdued nature. The technical outlook, with EUR/USD closing below the 100-day MA, suggests a potentially bearish bias. The upcoming ZEW Economic Sentiment figures for Germany and the Eurozone are expected to play a role in guiding the pair's trajectory.

GBPUSD

- GBP/USD is experiencing modest gains and is trading above 1.2700 during the European morning.

- Despite the UK's Unemployment Rate rising to 4.2% for the three months through June, Pound Sterling has managed to hold its ground due to strong wage inflation readings.

- The UK's Real Gross Domestic Product (GDP) expanded at an annual rate of 0.4% in the second quarter, surpassing market expectations of a 0.2% growth. Additionally, other data showed positive increases of 1.8% and 2.4% in Industrial Production and Manufacturing Production, respectively, on a monthly basis in June.

- Average Earnings, both including and excluding bonuses, for the three months to June showed significant improvement. This data adds weight to hawkish expectations from the Bank of England (BoE).

- The market's attention is likely to turn to the upcoming US Producer Price Index (PPI) data in the second half of the day, which could provide fresh impetus for the GBP/USD pair.

| SMA (20) | Falling |

|

|

| RSI (14) | Slightly Rising |

|

|

| MACD (12, 26, 9) | Neutral |

Closing statement:GBP/USD is observing modest gains above 1.2700 in the European morning. Despite the UK's rising Unemployment Rate, strong wage inflation readings have supported the Pound. Positive GDP figures, including Industrial Production and Manufacturing Production increases, have also contributed to a positive sentiment. Improved Average Earnings data further strengthens the hawkish expectations from the Bank of England (BoE). The focus for the remainder of the day will be on the US Producer Price Index (PPI) data, which could influence the pair's movement.

GOLD

- Gold prices are struggling to gain significant momentum on Tuesday and are trading within a narrow range just above the $1,900 mark.

- Investor worries over China's deteriorating economic conditions are providing some support to the safe-haven appeal of gold. This concern is a significant factor influencing market sentiment.

- A surprise rate cut by the People's Bank of China (PBoC) has done little to alleviate market apprehensions. This has helped gold maintain its position above the key psychological level of $1,900.

- Despite these concerns, the potential for gold's upside remains limited due to the growing belief that the Federal Reserve (Fed) will keep interest rates at higher levels for an extended period.

- The prevailing market sentiment suggests that the possibility of another 25 basis points (bps) interest rate increase by the end of the year is still factored into trading decisions.

| SMA (20) | Falling |

|

|

|

| RSI (14) | Slightly Falling |

|

||

| MACD (12, 26, 9) | Falling |

|

|

Closing statement: Gold prices are struggling to find strong momentum and are hovering just above the $1,900 mark. The market remains concerned about China's economic conditions, supporting gold's safe-haven status. A recent rate cut by the PBoC has not significantly eased market worries. However, gold's potential for substantial gains is limited due to the prevailing expectation that the Federal Reserve (Fed) will maintain higher interest rates for a prolonged period. The market is still pricing in the possibility of another 25-bps interest rate increase by the end of the year.

CRUDE OIL

- Crude oil prices have shown a slight increase on Tuesday, with China's unexpected decision to cut key policy rates for the second time in three months providing some support.

- The recent industrial output and retail sales data from China indicated a further slowdown in the economy. This data has created additional pressure on China's already struggling economic growth, leading authorities to implement key policy rate cuts to stimulate economic activity.

- Despite the weakened macroeconomic indicators, China's demand for oil has demonstrated resilience. Refineries have maintained elevated production levels to meet both domestic summer travel demand and to capitalize on favorable regional profit margins through fuel exports.

- Another factor supporting oil prices is Japan's unexpected robust economic growth in the second quarter, driven by strong auto exports and tourist arrivals. This growth has helped counterbalance the drag caused by a slower post-COVID consumer recovery.

- The ongoing production cuts by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) have been contributing to the global oil supply tightness. Coupled with the declining U.S. output, this trend has the potential to exacerbate the overall supply constraints.

| SMA (20) | Rising |

|

|

| RSI (14) | Slightly Rising |

|

|

| MACD (12, 26, 9) | Slightly Falling |

|

Closing statement: Crude oil prices have inched higher, influenced by China's decision to cut key policy rates to stimulate its economy despite weak economic indicators. China's oil demand has shown resilience, with refiners maintaining production to meet both domestic and export demands. Additionally, Japan's stronger-than-expected economic growth has also lent some support to oil prices. The ongoing production cuts by OPEC+ and the declining U.S. output are contributing to global supply tightness, further influencing oil prices.

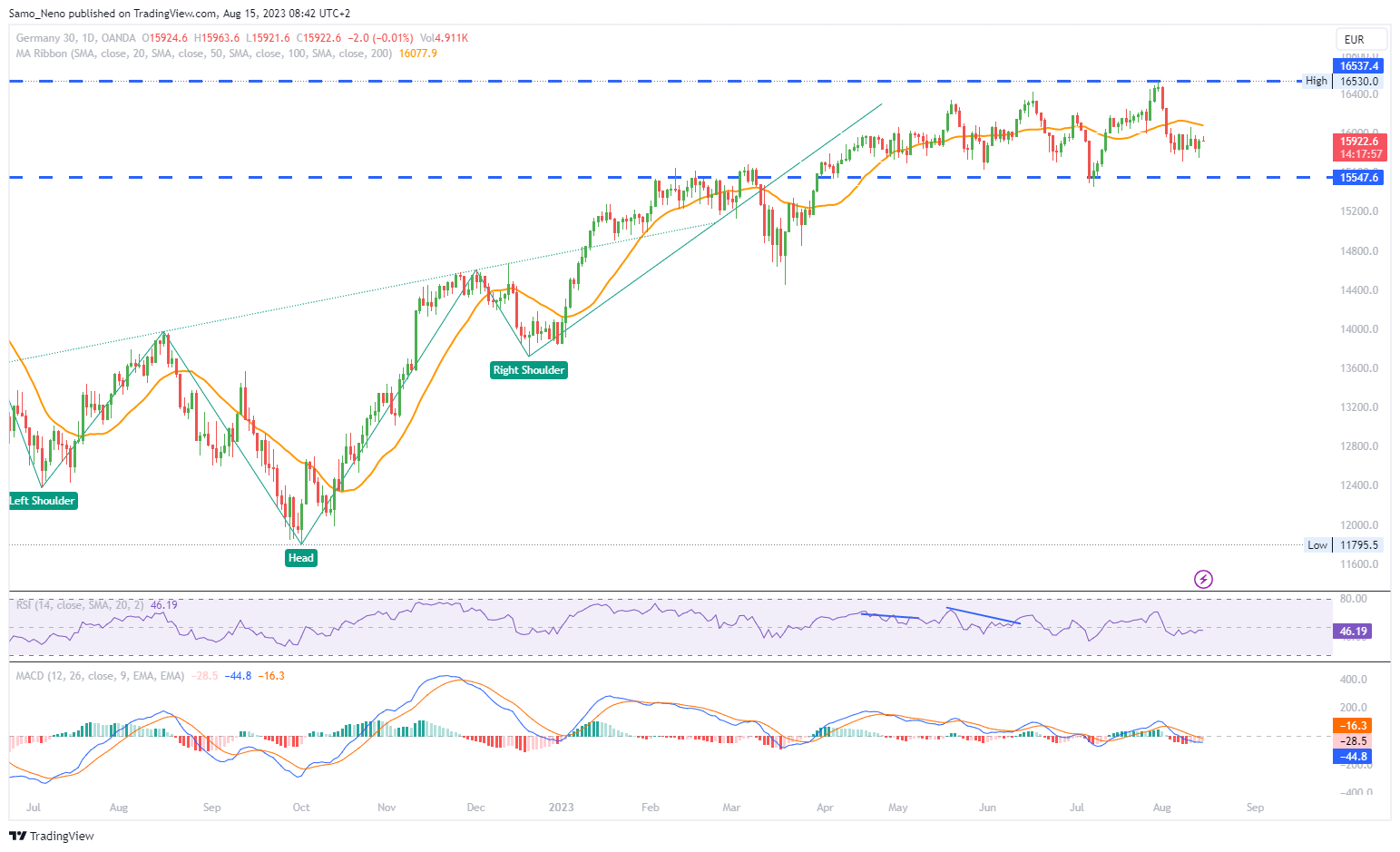

DAX

- The Germany stock market exhibited mixed performance on Monday. Sectors like Food & Beverages, Software, and Telecoms saw gains, whereas the Construction, Basic Resources, and Financial Services sectors experienced losses.

- Germany's Wholesale Price Index (WPI) for July showed a slight increase, with the year-on-year figure rising to -2.8% from the previous -2.9%. However, this reading fell short of the market's expectation of -2.6%. On a monthly basis, the WPI remained at -0.2%, in contrast to market forecasts of -1.4%.

- The German Economy Ministry reacted to the data by stating that current early indicators do not yet suggest a sustainable economic recovery in the coming months. However, the ministry also pointed out that there are signs of hope in the expected cautious recovery in private consumption, services, and investment. These signs are expected to strengthen as the year progresses.

- Given that China's economic data often sets the tone for DAX stocks, its impact on the DAX's performance can be significant. It's important to note that weak economic indicators from China can lead to cautiousness in the DAX's performance.

- The upcoming Germany's ZEW Economic Sentiment figures are forecasted to decline further. These sentiment figures are closely watched by investors as they provide insights into the expectations for the German economy's future performance.

| SMA (20) | Slightly Falling |

|

| RSI (14) | Neutral | |

| MACD (12, 26, 9) | Neutral |

Closing statement:The Germany stock market, as represented by the DAX, had a mixed trading day with varying sectoral performances. While the Wholesale Price Index (WPI) data showed a slight increase, the German Economy Ministry's cautious stance on the economic recovery tempered optimism. Investors are keeping a close eye on China's economic data as it can influence DAX performance. Additionally, the upcoming ZEW Economic Sentiment figures are expected to decline, potentially impacting investor sentiment regarding the German economy's future trajectory.